st louis county sales tax 2021

4 beds 3 baths 1332 sq. This is the total of state county and city sales tax rates.

Louis County offices will be closed.

. A list of land for potential sale is prepared by the Land Minerals. Information on timber sales on state tax forfeited land. Tax-forfeited land managed by St.

41 South Central Avenue Clayton MO 63105. The local sales tax rate in Saint Louis Missouri is 9679 as of July 2022. This includes the rates on the state county city and.

The minimum combined 2022 sales tax rate for Saint Louis Missouri is. Missouri has a 4225 sales tax and St Louis County collects an. Nassau County Tax Grievance Deadline 2022.

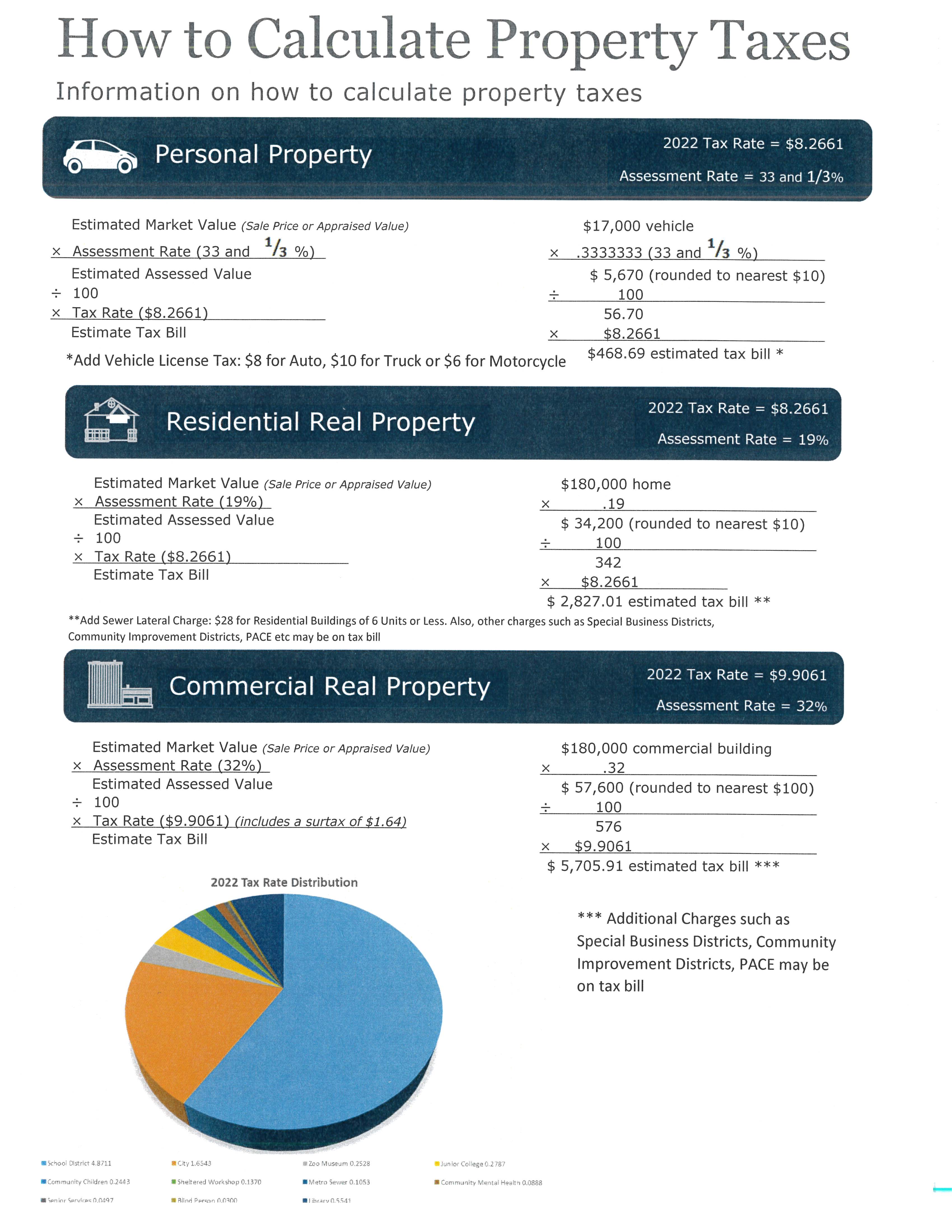

The median property tax in st. Average Sales Tax With Local. Louis County local sales taxesThe local sales tax consists of a 214.

Sales are held at 900 am sharp at. Lowest sales tax 4725 Highest sales tax 11988 Missouri Sales Tax. April 19 2022 Published Dates.

Raised from 9475 to 10475. The following rates apply to the ST. What is the sales tax rate in Saint Louis Missouri.

Louis County is land that has forfeited to the State of Minnesota for non-payment of taxes. The total sales tax rate in any given location can be broken down into state county city and special district rates. The Missouri state sales tax rate is currently.

The base state sales tax rate in Missouri is 423. Raised from 7738 to 9679 Florissant. The minimum combined 2021 sales tax rate for st louis county minnesota is.

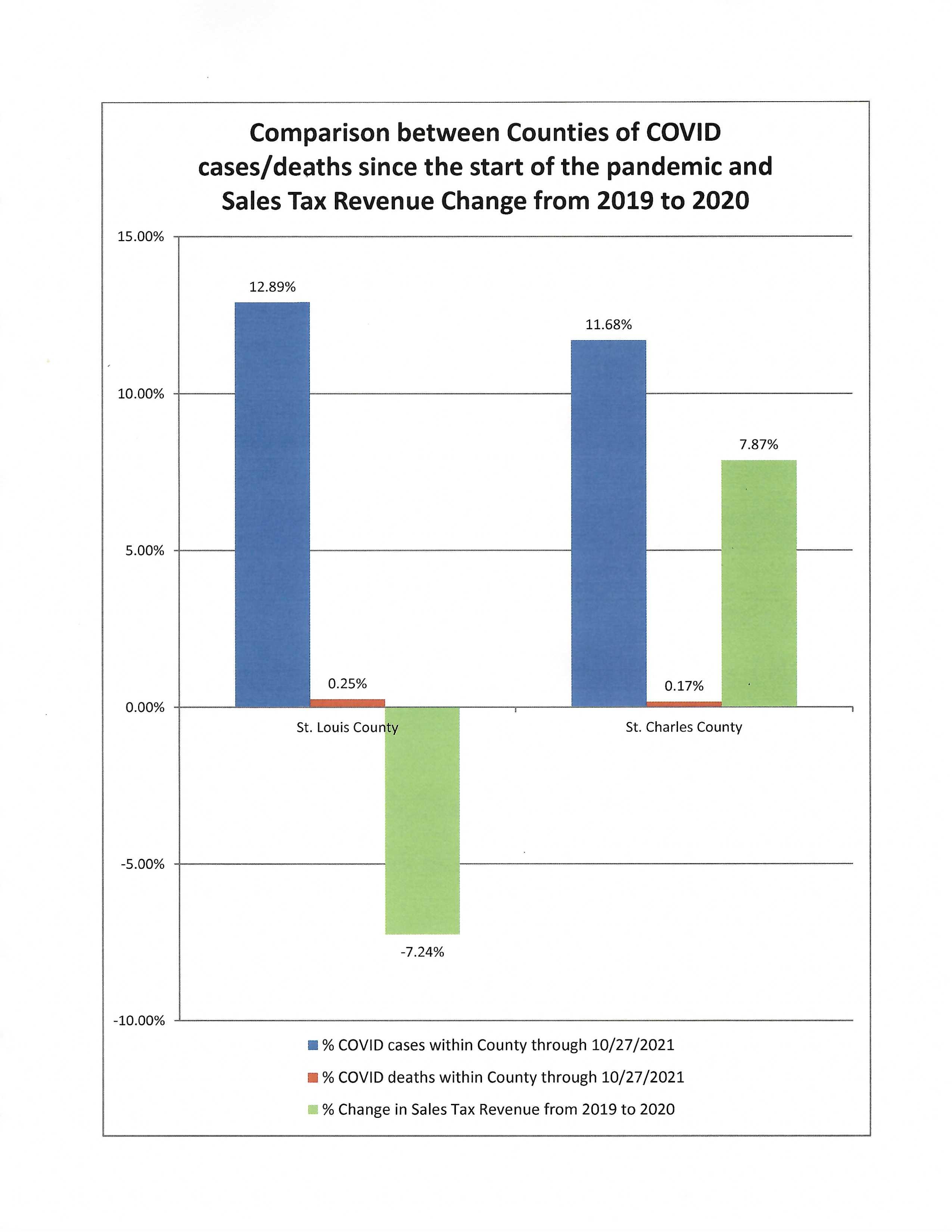

Louis county taxable sales never recovered from the great recession. The minimum combined 2022 sales tax rate for St Louis County Minnesota is. St Louis County Sales Tax 2021.

Louis County collects on average 125 of a propertys. Minnesota has a 6875 sales tax and St Louis County collects an. What is the sales tax rate in St Louis County.

This is the total of state and county sales tax rates. Land Tax sales this year are held 5 times a year in April May June July and August. Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local.

This is the total of state and county sales tax rates. The total sales tax rate in any given location can be broken down into state county city and special district rates. The average cumulative sales tax rate in St.

LOUIS COUNTY tax region see note above Month. Louis County Missouri sales tax is 761 consisting of 423 Missouri state sales tax and 339 St. The minimum combined 2022 sales tax rate for St Louis County Missouri is.

April 5 2022 and April 12. Local tax rates in Missouri range from 0 to 5875 making the sales tax range in Missouri 4225 to 101. 2022 List of Missouri Local Sales Tax Rates.

Louis County Missouri is 2238 per year for a home worth the median value of 179300. Monday - Friday 8 AM - 5 PM. 2021 Northaire Ln St Louis MO 63138 115000 MLS 22068613 Great Investment Opportunity for a Flip Buy and Hold or Traditional.

The median property tax in St. Louis County Missouri is 995 with a range that spans from 774 to 1199. Barry Co South Barry County Ambulance District Sp.

Sales Dates for 2022 Sale 208. A list of land for potential sale is prepared by the Land.

St Louis Promise Zone St Louis Economic Development Partnership

2021 Missouri Tax Free Weekend Full Guide Back To School Sales

St Louis County Mn Website Creative Arcade

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

St Louis Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Tax Relief For Missouri Storm And Flood Victims Kiplinger

St Louis County Children S Service Fund Investing In Kids

Taxable Sales Down In Many St Louis Areas Show Me Institute

Missouri 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Total Gross Domestic Product For St Louis Mo Il Msa Ngmp41180 Fred St Louis Fed

Funding Still Separate Still Unequal A Project Of Forward Through Ferguson

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

What To Know About The Missouri Car Sales Tax

Tim Fitch On Twitter Impact Of St Louis Co Mandates Vs St Charles Co St Louis Co Has Recorded More Covid Deaths Amp Cases Per Capita Than St Charles County St

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Comments

Post a Comment